What Is the Outlook for the Ice Rink Market ?

The industry as a whole has an aging infrastructure and is in need of an update. An estimated 75% of currently operating National Hockey League (NHL) ice arena venues were built in the mid-1990s or before. In addition to these larger arenas, there are many more private, community, and locally owned rinks spread across North America. Many of these rinks are older and are nearing, if not well past, the expected usable lifetime of the refrigeration systems that enable the rink’s ice making.

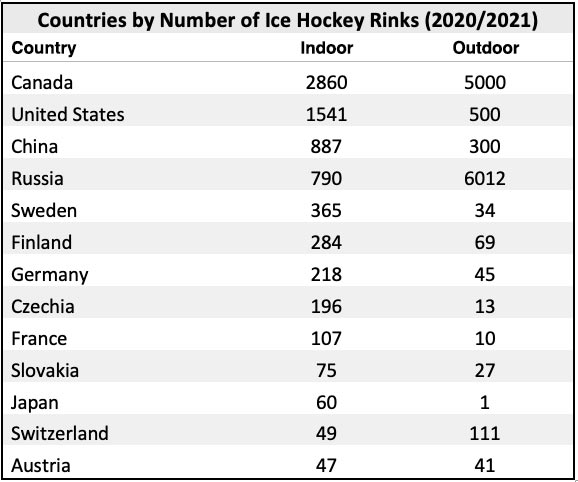

The ice skating rink market is divided into type and application. Based on type, the market has been further segmented into outdoor and indoor. The outdoor segment dominated the market in previous years, as outdoor rinks tend to be cost-effective and eco-friendly. However, the indoor segment is expected to grow over the coming years as, unlike outdoor rinks which tend to be seasonal and thereby only available for a limited time, indoor rinks have no such limitation and can be used throughout the entire year.

This industry is highly fragmented with no major players having a market share of greater than 5%.

The largest share of the global ice skating rink market is commanded by North America due to the presence of well-established ice-skating rink providers which tends to influence the region’s market growth.

The Ice Rinks industry is expected to continue to benefit from the effects of pent-up demand (caused by COVID-19) in 2022, albeit at a lesser rate than 2021. Consumers may well spend less time on leisure and recreational activities in 2022 as they resume more day-to-day routines and activities previously deterred by the pandemic, threatening a quick, full-industry recovery.

Industry profitability is expected to recover from lows related to the COVID-19 pandemic. However, increased overhead costs, a residual of the pandemic, are expected to hold down growth in the average industry profit margin.

What is the market size of the Ice Rinks industry in the US in 2022?

- The market size, measured by revenue, of the Ice Rinks industry is projected at $500.9m in 2022.

What is the growth rate of the Ice Rinks industry markey in the US in 2022?

- The Ice Rinks industry market is expected to grow 3.1% in 2022.

Has the Ice Rinks industry in the US grown or declined over the past 5 years?

- The market size of the Ice Rinks industry in the US has declined 4.8% per year on average between 2017 and 2022.

Is the Ice Rinks industry in the US expected to grow or decline over the next 5 years?

- The Ice Rinks industry is projected to show growth over the next five years, however total industry revenue will remain below pre-pandemic levels as a result of mandated ice rink closures due to COVID-19. Still, as economic conditions continue to rebound from COVID-19 restrictions, rising per capita disposable income is expected to benefit industry growth moving forward. Overall, per capita disposable income is projected to increase over the next five years, enabling more consumers to afford regular trips to ice rinks, and improve consumers’ ability to afford costs (participation and equipment) related to ice sports. Industry ice rinks will likely benefit most from rising participation in sports, as hockey and figure skating clubs require ice rinks to operate.

What is the biggest growth opportunity for the Ice Rinks industry in the US?

- Consumer spending measures the total value spent on final goods and services for personal consumption or enjoyment by consumers. Consumer spending generally follows business cycle patterns. For instance, during an economic expansion, consumer spending generally rises as unemployment declines and income increases. Thus, in 2022, improving economic conditions are expected to increase consumer spending, representing a potential opportunity for the industry.